Who can get a pension refund on leaving Germany

Can I get a pension refund when I’m leaving Germany?

Of course you can! It is indeed possible to get your money back from the pension scheme in Germany. If you meet certain criteria, you can get thousands of Euros back.

Here are the details: If you have been employed in Germany and have made contributions to the statutory pension insurance, you can apply for a refund under specific conditions.

However, it’s important to note that this option becomes available only after a two-year period from the termination of your employment. To be precise, you must wait for 24 months following your last pension insurance contribution before you can apply for the refund.

Your eligibility may also be affected by factors such as your nationality and the country in which you currently reside. In addition, you may want to consider taking our eligibility test for a personalized assessment.

Who is eligible for the reimbursement in Germany?

The German statutory pension insurance is not very inclined to refund contributions. Therefore, you must meet certain requirements in order to receive your pension.

The reimbursement of contributions from the German statutory pension insurance can be difficult due to certain restrictions. The purpose of these restrictions is to discourage premature decisions to repay contributions, as doing so terminates the insurance relationship and forfeits all pension rights under the statutory pension scheme.

While the refund amounts can be substantial, the process itself is known for being lengthy, complex, and confusing.

Generally, there are three main categories of individuals who may be eligible for a pension refund:

- Civil servants and individuals in similar positions to civil servants.

- Individuals who have reached the standard retirement age but do not meet the general waiting period requirement.

- Foreigners who have worked in Germany and subsequently emigrated.

However, it’s important to note that even within these groups, specific requirements must be met to qualify for a pension refund when leaving Germany.

Requirements for the pension refund on leaving Germany

To qualify for an early payout of your pension contributions, you need to fulfill the following three basic requirements:

- You should no longer be liable to pay contributions in Germany.

- The last contribution payment you made must be at least 24 months ago.

- You must not have the option to voluntarily contribute to the German pension insurance scheme

Whether you have the option to make voluntary contributions depends on your nationality and current residence.

The German Pension Insurance categorizes potentially eligible individuals into four groups:

- German citizens

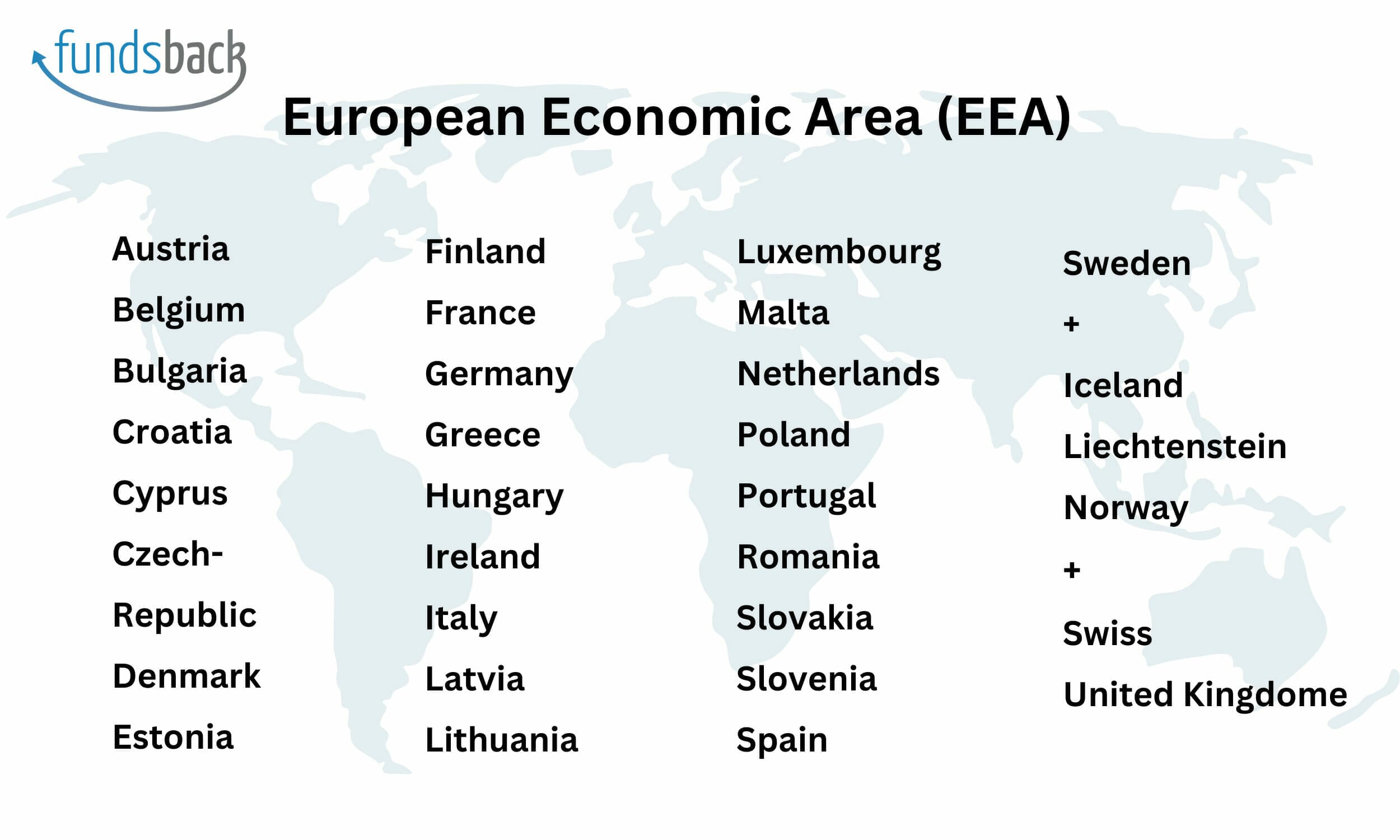

- Citizens of countries in the European Economic Area (EEA), as well as Switzerland and the United Kingdom (UK)

- Citizens of contracting states

- Citizens of non-contracting states

In summary: Your eligibility for a pension refund primarily depends on your citizenship and current country of residence. If you still have the option to make voluntary contributions to the German statutory pension insurance, you are not eligible to have your pension contributions paid out.

Let’s check your eligibility! Press the button to use our free eligibility check.

1. German citizens and nationals

Unfortunately, as a German citizen, you are not eligible for a pension refund. Regardless of your current country of residence, being a German citizen gives you the option to voluntarily contribute to the pension insurance system until you reach retirement age.

Therefore, German citizens are generally not eligible for a pension refund, even if they hold dual citizenship.

There are 2 exceptions

However, there are certain circumstances in which German nationals may receive a payment of their contributions.

These include situations where individuals have civil servant status or have reached the legal retirement age but have not completed the general waiting period requirement.

In such cases, eligible German nationals may be able to have their contributions paid out subject to the above conditions.

2. EEA citizens, Switzerland & UK

If you live in a country in the European Economic Area, you have almost no chance of a successful pension refund. This is because you are treated as a German citizen by EU law.

In this case, you will not be able to claim your pension until you reach the German retirement age. If you are not entitled to a “normal” German pension, you can apply for a refund.

To be eligible for a refund, you must have paid into the pension scheme for at least five years. From 2023, the retirement age in Germany will be 66, but please note that it will be gradually increased to 67 by 2031.

EEA is the acronym for the European Economic Area, which includes all 27 EU countries plus Iceland, Liechtenstein and Norway.

What about Switzerland and the United Kingdom?

Switzerland is neither part of the EU nor the EEA.

However, it is linked to the EU by many treaties, which means that Swiss citizens have equal rights with EU citizens in most areas. The same rule applies to the United Kingdom since Brexit.

Suppose you are a citizen of an EEA country (other than Germany), Switzerland, or the United Kingdom. In this case, you can also voluntarily pay into the German pension system until you reach retirement age. A German pension refund is therefore only possible once you have reached retirement age.

Which countries belong to the European Economic Area (EEA)?

3. Contracting states

Contracting states are countries that have a social security agreement with Germany.

If you are a citizen of a treaty country, you have a good chance of getting a pension refund when leaving Germany.

You qualify for a refund if:

- You have worked in Germany for less than 5 years and currently reside in a contracting state or a non-contracting state.

Please note that in most cases, if you have made pension contributions for more than 59 months, you will not be eligible for a refund, regardless of your place of residence.

Which countries are among the contracting states?

Here is more information about the countries that are party to the social agreement: Bundesjustizamt.de

4. Non-contracting states

As a citizen of a non-contracting state, you have a high probability of receiving a refund of your pension contributions.

If you are not a citizen of a country in the European Economic Area (EEA) or a country that has a social security agreement with Germany, you are a non-contracting country. Non-contracting countries are those that do not have a social security agreement with Germany.

As a citizen of a non-contracting state, you are not entitled to make voluntary contributions to the German pension insurance system, regardless of your current place of residence. This circumstance greatly increases the likelihood of a successful refund of pension contributions.

You have a very good chance of receiving a pension refund if:

- You currently reside in a contracting state, regardless of the number of years you have worked in Germany.

or

- You currently reside in a non-contracting state, irrespective of the duration of your employment in Germany.

Which countries count as non-contracting states?

Non-contracting states refer to countries that are not part of either the contracting states or the European Economic Area (EEA). Examples of non-contracting states include Russia, Mongolia, Kazakhstan, various African countries, Iraq, Iran, Saudi Arabia, Peru, Argentina, Bolivia, Mexico, Korea, and more.

If a country does not fall within the EEA or the contracting states, it is categorized as a non-contracting state. This means that it has not established a social security agreement with Germany.

Afghanistan, Algeria, American Samoa, Andorra, Angola, Anguilla, Antigua & Barbuda, Argentina, Armenia, Aruba, Azerbaijan,

Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belize, Benin, Bermuda, Bhutan, Bolivia, Botswana, British Virgin Is., Brunei, Burkina Faso, Burma, Burundi,

Cambodia, Cameroon, Cape Verde, Cayman Islands, Central African Rep.m, Chad, China, Colombia, Comoros, Congo, Dem. Rep., Congo, Repub. of the Cook Islands, Costa Rica, Cote d’Ivoire, Cuba,

Djibouti, Dominica, Dominican Republic,

East Timor, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Ethiopia,

Faroe Islands, Fiji, French Guiana, French Polynesia,

Gabon, Gambia, Gaza Strip, Georgia, Ghana, Greenland, Grenada, Guadeloupe, Guam, Guatemala, Guernsey, Guinea, Guinea-Bissau, Guyana,

Haiti, Honduras, Hong Kong,

Indonesia, Iran, Iraq, Isle of Man,

Jamaica, Jersey, Jordan,

Kazakhstan, Kenya, Kiribati, Korea, North, Kuwait, Kyrgyzstan,

Laos, Lebanon, Lesotho, Liberia, Libya,

Macau, Madagascar, Malawi, Malaysia, Maldives, Mali, Marshall Islands, Martinique, Mauritania, Mauritius, Mayotte, Mexico, Micronesia, Fed. St., Monaco, Mongolia, Montserrat, Mozambique, N. Mariana Islands,

Namibia, Nauru, Nepal, Netherlands Antilles, New Caledonia, New Zealand, Nicaragua, Niger, Nigeria, Oman,

Pakistan, Palau, Panama, Papua New Guinea, Paraguay, Peru, Puerto Rico, Qatar,

Reunion, Russia, Rwanda,

Saint Helena, Saint Kitts & Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, San Marino, Sao Tome & Principe, Saudi Arabia, Senegal, Seychelles, Sierra Leone, Singapore, Solomon Islands, Somalia, South Africa, Sri Lanka, St Pierre & Miquelon, Sudan, Suriname, Swaziland, Syria,

Taiwan, Tajikistan, Tanzania, Thailand, Togo, Tonga, Trinidad & Tobago, Turkmenistan, Turks & Caicos Is, Tuvalu,

UAE – United Arab Emirates, Uganda, Uzbekistan,

Vanuatu, Venezuela, Vietnam, Virgin Islands,

Wallis and Futuna, West Bank, Western Sahara, Yemen,

Zambia, Zimbabwe

In short: Who is eligible for the pension refund in Germany

Only those who live outside the EU or the EEA (European Economic Area) and do NOT have EU or EEA citizenship are entitled to a pension refund when leaving Germany. This is because you can always make voluntary contributions to the German pension insurance within the EU/EEA.

In addition, the last contribution to the German pension insurance must be at least 24 months ago and you must have left Germany.

Take the eligibility test now and get your money back!

How much money can I recover in 2023?

The amount of pension refund you can receive from the German Pension Insurance in 2023 depends on various factors.

The German pension insurance is an important part of the social security system that supports individuals during retirement, illness and unemployment. If you are employed in Germany, you are automatically entitled to this social benefit. Pension benefits are funded by contributions from both employers and employees.

From 2023, the contribution rate for both employer and employee will be 9.3%, for a total of 18.6% of the employee’s gross income. It’s important to note, however, that only the employee’s personal contributions can be refunded, which is 9.3% in 2023.

The exact amount of the refund depends on the length of your employment in Germany and the amount of your gross income.

Your pension contributions are calculated on the basis of 9.3% of your monthly income up to a certain income threshold (€7050).

German Pension Refund Calculator

Before considering a refund of your pension contributions, it is beneficial to have an estimate of the potential amount you could receive. For this you can use our calculator.

The calculator is easy to use: just enter your gross monthly income and the total number of months you worked in Germany, and the calculator will give you an estimate. It calculates the refund amount by multiplying these values by the percentage of your gross salary that you contributed to the German pension insurance.

Feel free to give it a try and use our pension refund calculator to get an estimate of your potential refund amount.

We help you with the pension refund when you leave Germany. Contact us today to get started!